Exit strategies for covered call writing is the 3rd required skill that must be mastered to achieve the highest possible returns. In January 2020, a member shared with me a trade she executed with BlackRock, Inc. (NYSE: BLK). The stock was trading at a cost-basis of $500.00 when the February 21, 2020 deep out-of-the-money (OTM) call was sold for $5.59. Shortly after entering the trade, shares moved higher ($570.00) resulting in the ask price cost-to-close rising to $23.40. The question posed to me was should the option be re-purchased since this BCI member wanted to retain the shares.

Initial structuring of trade

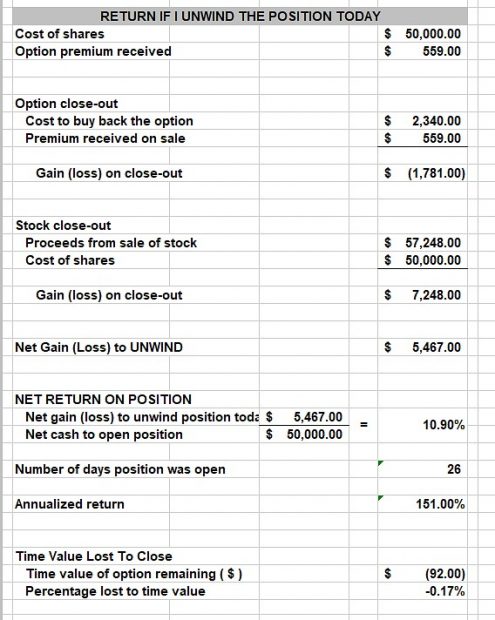

The spreadsheet shows an initial 1-month time value return of 1.1% with a possible additional 10% return if share value moved up to the $550.00 strike. With the stock trading at *$572.48, a maximum return of 11.1% was looking good.

*The original article had current market value at $570.00 but it had actually moved up to $572.48 when the image of the spreadsheet was created.

Time value cost-to-close

The option cost to buy back the $550.00 call is $23.40, $22.48 of which is intrinsic-value. If we close the original short call, our share value moves from the $550.00 strike to the current market value of $572.48. This results in a 0.17% time-value cost-to-close as shown in the

Unwind Now” tab of the Elite-Plus and the Elite version of the Ellman Calculator.

When would we opt to close early in the contract?

If we were willing to part with the stock, using the mid-contract unwind exit strategy (MCU) would make sense. This involves closing both legs of the covered call trade and using the cash to enter a covered call new position with a different underlying security and the same expiration date. As long as that new position would result in an initial time-value return of 1.17% or more (1% greater than the time-value cost-to-close), the MCU exit strategy would be beneficial.

What if share retention is a priority?

In this case, we wait until expiration approaches and roll the option prior to 4 PM ET on expiration Friday. We can roll-out to the same strike or roll-out-and-up depending on overall market assessment and calculation goals. We use the “What Now” tab of the Ellman Calculator to assist with these decisions.

Discussion

When our covered call strikes move deep in-the-money early in a contract, we have the following courses of action to consider depending on our goals:

- Mid-contract unwind exit strategy

- Rolling options as expiration approaches

- Take no action and allow assignment

Investment club program board members

If you would like to schedule a private webinar with Alan and Barry, send an email to:

info@thebluecollarinvestor.com

Include:

- Contact email

- Contact phone #

- Club website URL

- Put “private webinar” in the header

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Hello Alan,

Thanks for putting on this webinar during the coronavirus stay-at-home period. I saw you at The Money Show Las Vegas in 2019 and liked your presentation then and all the info you put into your weekly newsletters since. It is clear to me that your motivation is to educate people on investing, not to get rich yourself.

Keep up the great work.

Best,

David Y

Upcoming event

1: Private webinar (California investment club)

Covered Call Writing with 4 Practical Applications

Saturday September 19th

9 AM – 12PM PT

2: Money Show Virtual Event

Master Class (2-hour)

Creating a Covered Call Writing Portfolio Start to Finish

I am invited speaker for this event. The Money Show charges a fee to attend ($139)

September 16, 2020

3:45 – 5:45 ET

3: Free webinar for entire BCI community (October)

The feedback from our August 13th webinar was so positive, the BCI team decided to schedule another in the fall. I have written over 50 webinars over the years and will select one or write another based on your feedback regarding the topics you are most interested in. Send your ideas to: info@thebluecollarinvestor.com. We will publish the topic, date and time in the near future.

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************